Staff member leaving?

It can be a tricky time when an employee leaves an organisation even in the most amicable situations. There can be a lot to arrange or rearrange to protect the business during the transition. The difference for an SME is principally that all these issues fall to the CEO, CFO, chief cook and bottle washer […]

Terminating a lease

When Australian property owners and business owners enter into a commercial lease agreement, there are generally specific terms outlining the duties of both parties, the duration of the agreement, and any special terms, such as early termination. Choosing to end a commercial lease before the designated terms of the agreement (typically at least three years) can be […]

Travel Allowance

A travel allowance is a payment made to employees to cover accommodation, food, drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties. In most circumstances, when claiming other deductions, you will be expected to be able to substantiate the expense being claimed with documentary […]

Basics of payment arrangements

For many financially troubled businesses, the ATO is one of the first creditors that misses out on the payment cycle. Surprisingly to many, the ATO is quite reasonable in its dealings with taxpayers who are struggling to pay their tax debts. In fact, the ATO is very generous in the Payment Arrangements it will agree. […]

Benchmarking and Franchising

The economic climate presents various challenges. The world is opening up through the use of digital technologies, the pace of change is increasing and the power is very much with the consumer. Excitingly for franchise groups, this opens the door to embrace a raft of opportunities. Fundamentally, the success of the franchise model has not […]

Asset protection and bankruptcy

Every business comes with risk. Asset planning is an attempt to separate the beneficial ownership of assets from the risk of business failure and personal exposure. Lawyers and accountants are regularly asked to advise clients about the steps they should take to shield their assets from the risks of financial failure. Many asset planning structures […]

GST Margin Scheme for Developers

GST Margin scheme The GST margin scheme is a way of working out the GST one must pay while selling a property as part of a business. The margin scheme can only be applied if the sale of the property is taxable. If property is purchased where the margin scheme was applied to the sale, GST credit for […]

Margin Scheme for Developers

The Margin Scheme is provide for under Div. 75 of the New Tax System (Goods and Service Tax) Act 1999 (GST Act). Margin Scheme is available on the sale (taxable supply) of real property by – Written Agreement There must be a written agreement between the seller (vendor) and the purchaser for the margin scheme […]

Replacing a liquidator

Recent reforms under the Insolvency Law Reform Act intended to make the replacement of an External Administrator/Liquidator easier for creditors to achieve but in reality, it may have had the opposite effect. In the past, liquidations instigated by the directors/shareholders required the appointee take the lead and put a resolution to creditors within 18 days of appointment […]

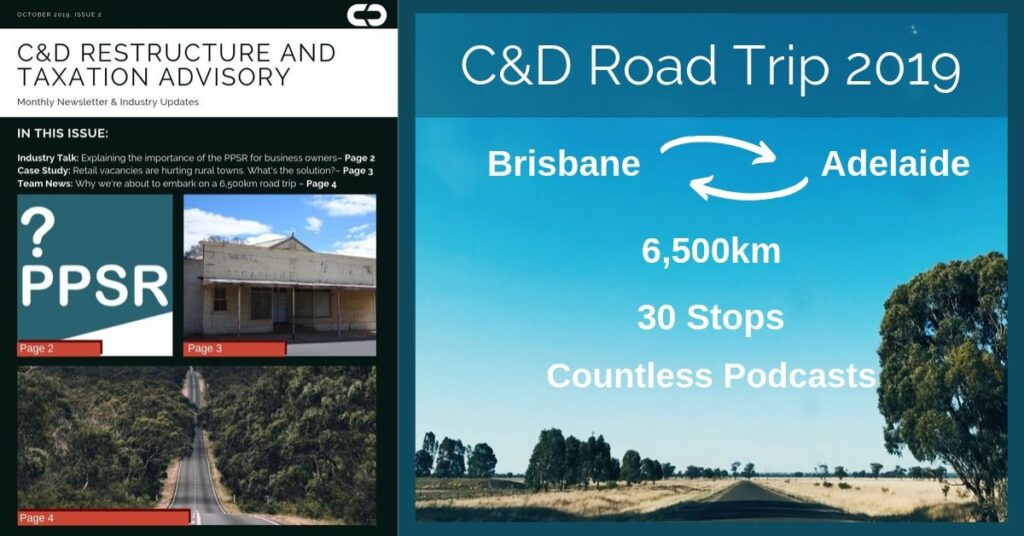

C&D Advisory Newsletter Issue 2

Our October newsletter deals with the importance of the PPSR for business owners and the issue of high shop vacancy rates in rural towns. In team news, we discuss why we’re about to embark on a 6,500km road trip! Newsletter Issue 2